Welcome to 8 Commercial Finance CO.

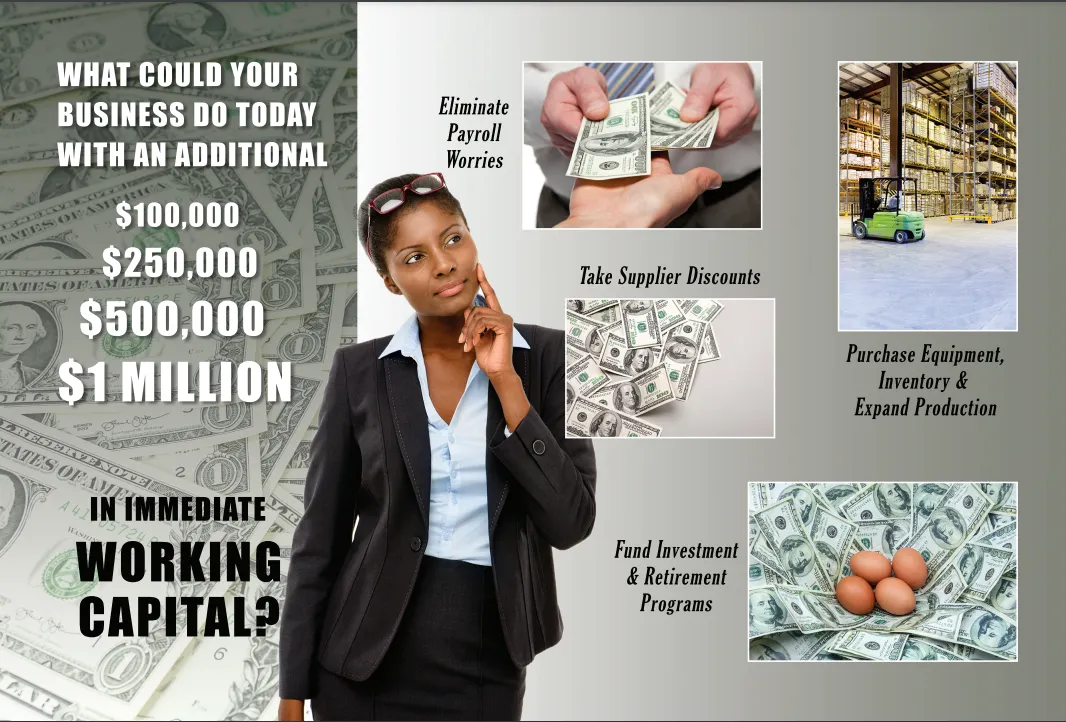

Up to $1 Million In Ready Working Capital

Benefits of Using a Factoring Broker

.png)

Best Deal/Rates

Factoring brokers collaborate with you and your business to develop a customized financing plan tailored to your industry and specific circumstances. They will connect you with a factoring company that aligns with your needs and requirements.

The right Funder

Factoring brokers work with you and your business to create a specialized financing plan that fits your industry and circumstances. They’ll match you with a factoring company that supports your needs.

FASTER FUNDING

Partnering with a factoring broker can help you secure funding much faster than a traditional bank loan. In fact, you could receive funds in just a few hours in some cases! Don’t let lengthy bank processes hold you back—experience quick and efficient funding solutions

In today’s challenging inflationary economy, more and more business owners are finding it difficult, if not impossible, to secure adequate working capital. In fact, the Biz2Credit Small Business Lending Index recently released their lending statistics and they were not good. Larger banks are only approving only 14.2% of business loan applications.

For small business owners and startup entrepreneurs, however, there’s good news. At 8 Commercial Finance Co, we are providing ready working capital through the use of alternative commercial finance solutions that the vast majority easily qualify for!

Contact us for all your small business finance needs!

phone: 773-988-8393

GET YOUR FREE EBOOK

Beyond the Bank:

Alternative Funding Solutions for Entrepreneurs.

Frequently Asked Questions

A factoring broker serves as a crucial link for businesses seeking faster payment for their invoices by connecting them with invoice factoring companies ready to assist. With deep industry insights and a diverse network of partnerships across various factoring firms, factoring brokers are well-positioned to facilitate these connections.

From the blog

Factoring brokers are not just matchmakers; they provide expert market knowledge, negotiate favorable terms, and assist with the complex application processes. Their expertise helps businesses save time, secure better rates, and navigate the often-complex landscape of factoring services. When choosing a factoring broker, companies should prioritize experience, reputation, and transparency to ensure a successful partnership.

Unlock Business Growth with Tailored Commercial Finance Solutions

Navigating the World of Commercial Finance ServicesIn today's dynamic business landscape, access to capital is crucial for companies to thrive and grow. Commercial finance services play a pivotal role in providing businesses with the financial resources they need to seize opportunities, manage cash flow, and navigate complex financial challenges. From factoring and purchase order financing to equipment leasing and microloans, these services offer a wide array of solutions tailored to meet the diverse needs of businesses across various industries.Factoring: Unlocking Working Capital

Unleashing Business Potential: A Comprehensive Guide to Commercial Finance Services

Factoring is a financial transaction in which a business sells its accounts receivable (outstanding invoices) to a third-party factoring company at a discounted rate. This practice provides businesses with immediate access to working capital, enabling them to maintain steady cash flow and meet operational expenses without waiting for customers to pay their invoices. Factoring can be particularly advantageous for industries with long payment cycles or those experiencing rapid growth.Purchase Order Financing: Fueling Growth

Mastering Debt Recovery: Proven Strategies to Reclaim What You're Owed

Are unpaid debts affecting your bottom line? At 8 Commercial Finance Debt Collection, we specialize in providing top-tier debt recovery services tailored to your unique needs. Whether it's consumer debt, commercial accounts, or even government debt, our expert team is equipped with the skills and experience to handle it all.

Learn how our customized solutions, legal compliance, and proven strategies can help recover overdue payments quickly and efficiently. We prioritize professionalism, maintaining strong client relationships while securing the results you deserve. Don't let outstanding debts hold you back—partner with the leaders in debt collection services today!

© 2024 8 Commercial Financing Co.., All Rights Reserved.