Welcome to 8 Commercial Finance Co.

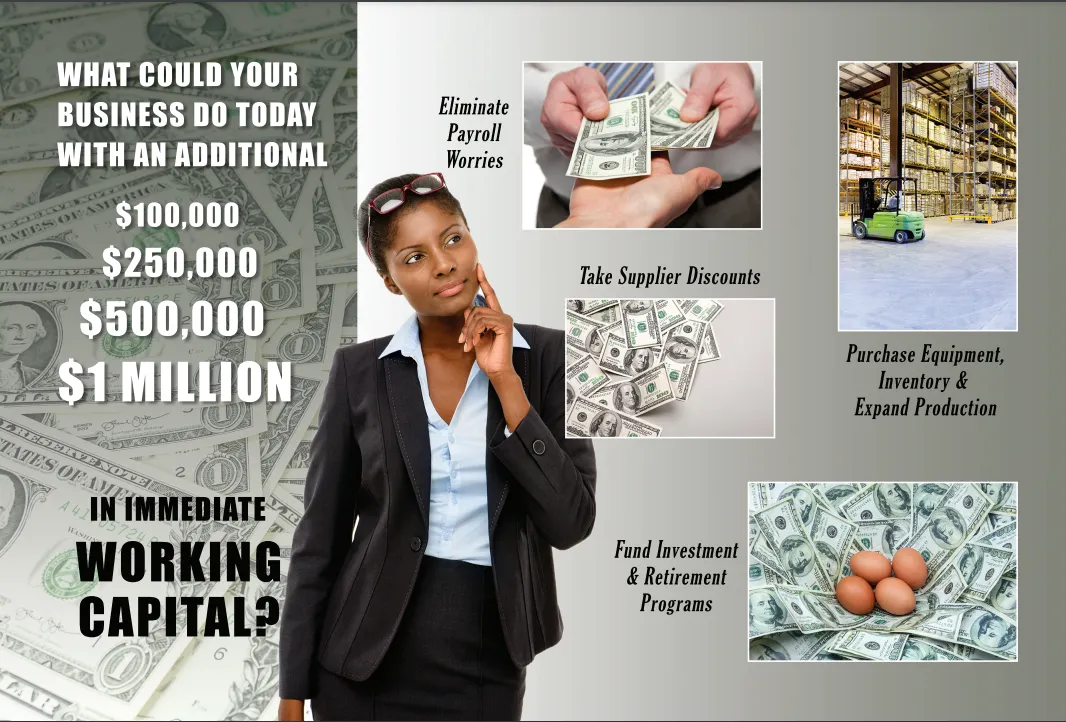

Up to $1 Million In Ready Working Capital

In today’s challenging inflationary economy, more and more business owners are finding it difficult, if not impossible, to secure adequate working capital. In fact, the Biz2Credit Small Business Lending Index recently released their lending statistics and they were not good. Larger banks are only approving only 14.2% of business loan applications.

For small business owners and startup entrepreneurs, however, there’s good news. At 8 Commercial Finance Co, we are providing ready working capital through the use of alternative commercial finance solutions that the vast majority easily qualify for!

Contact us for all your small business finance needs!

phone: 773-988-8393

GET YOUR FREE EBOOK

Beyond the Bank:

Alternative Funding Solutions for Entrepreneurs.

Frequently Asked Questions

A factoring broker serves as a crucial link for businesses seeking faster payment for their invoices by connecting them with invoice factoring companies ready to assist. With deep industry insights and a diverse network of partnerships across various factoring firms, factoring brokers are well-positioned to facilitate these connections.

Understanding Factoring Brokers: Your Guide to Smooth Cash Flow Management.

In the world of business finance, cash flow management is crucial for maintaining healthy operations. One of the strategies companies employ to manage cash flow effectively is factoring. A key player in this process is the factoring broker. In this article, we'll explore what a factoring broker is, how they operate, and the benefits they bring to businesses seeking financial solutions.

What is Factoring?

Before diving into the specifics of factoring brokers, it’s important to understand the concept of factoring itself. Factoring is a financial transaction where a business sells its accounts receivable (invoices) to a third party, known as a factor, at a discount. This allows businesses to receive immediate cash, rather than waiting for customers to pay their invoices.

Unlock the Door to Growth: Understanding the Eligibility Requirements for Small Business Loans

Eligibility Requirements for Small Business Loans: A Comprehensive Guide.

As a small business owner, accessing capital can be a significant challenge. However, with the right financing options, you can overcome this hurdle and take your business to the next level. In this article, we will explore the eligibility requirements for small business loans, helping you make an informed decision about which financing option is best for your business.

What are Small Business Loans?

© 2024 8 Commercial Financing Co.., All Rights Reserved.